The Single Strategy To Use For Accounting Franchise

Table of ContentsAccounting Franchise Things To Know Before You Get ThisWhat Does Accounting Franchise Do?Accounting Franchise for DummiesFascination About Accounting FranchiseAccounting Franchise Can Be Fun For AnyoneAccounting Franchise Can Be Fun For EveryoneAn Unbiased View of Accounting FranchiseAccounting Franchise Fundamentals Explained

In numerous instances, the franchisor has established partnerships with providers that permit its franchisees to acquire goods at a reduced cost compared to the rate independent proprietors of a comparable service may be able to negotiate for themselves. In cases, funding may be much easier to safeguard. Banks and various other lending institutions are often extra appropriate to lending cash to those seeking to buy a franchise business because of an existing knowledge of the franchisor's item or solution.Some franchisors put in a degree of control that you might find also limiting. Royalties, a charge established for the continued use of the franchisor's hallmarks and trademarked processes, normally will need to be paid to the franchisor routinely.

You would have to spend money on marketing or modern technology for any company you run, however in a franchise relationship these expenses are established by the franchisor. Business online reputation is rather reliant on others who also run the same franchise.

The 7-Minute Rule for Accounting Franchise

The majority of franchisors, if they offer renewal civil liberties, will certainly renew a franchise business if the franchisee is in good standing. Good standing is typically established by a collection of requirements outlined in the franchise business agreement.

With clear documents, franchisees and franchisors can rapidly gauge their monetary health, comprehend which services are one of the most lucrative, and identify where prices might be cut. This quality is not just for business owners yet also for stakeholders, financiers, or also for possible franchise customers. Prompt payments to vendors, timely payroll, and efficient supply monitoring are some operational components that count on accurate bookkeeping.

What Does Accounting Franchise Do?

Financial institutions, loan providers, and capitalists often take into consideration constant and precise bookkeeping as an indication of a business reliability and reliability. While it may seem like bookkeeping adds to the jobs of a franchise business, over time, it saves both time and money. Accounting Franchise. Envision the effort required to backtrack and recreate monetary declarations in the lack of regular bookkeeping

The heart of any type of business exists in its economic pulse. For a home solution franchise business, among the difficulties of solution top quality, consumer connections, and operational efficiency, is simple to forget the foundational role of bookkeeping. As detailed above, this 'back-offic task is a giant of understandings, securities, and development approaches.

How Accounting Franchise can Save You Time, Stress, and Money.

It outfits a franchise business with the tools to prosper in today's competitive market and paves the method for a sustainable, rewarding future.

By Charles Dean Smith, Jr., CPAStrong accountancy techniques lay a solid foundation for developing success as a franchise proprietor. In this short article, the specialists from the Franchise Technique at PBMares rundown several ideal methods for franchise business accountancy. When his response addressing any kind of sort of bookkeeping, the starting factor for establishing ideal methods is to ensure the numbers are precise.

Setting practical monetary goals and monitoring efficiency using KPIs allows franchise proprietors to. Being positive this way promotes monetary security, growth, accountability, and openness within the franchise business system. Most local business owner locate themselves subject to continuous quarterly approximated revenue taxes once they come to be profitable. Your tax obligations will certainly differ relying on the entity type, area, and dimension of your franchise business.

Accounting Franchise Things To Know Before You Get This

To remain ahead and stay clear of overwhelm when dealing with tax responsibilities: for quarterly approximated federal and state revenue tax obligations. as this will aid dramatically with capital planning and avoid tax underpayment fines and passion, which have actually ended up being substantial in the past year as market rates of interest boost. for the forthcoming year as they prepare your yearly tax return filing.

No matter exactly how small the business may be, it's crucial to value business entity in regards to separating accounts, maintaining economic declarations, and monitoring costs. Franchise Audit Best Technique # 7: Leverage the Franchisor SystemsOne advantage of possessing a franchise is having the ability to take advantage of the already-established and examined systems and procedures of the franchisor.

Rumored Buzz on Accounting Franchise

The appeal of franchising frequently exists in its "plug and play" model. You reach run under a recognized brand name, gaining from their advertising and marketing muscle, operational visite site systems, and typically a comprehensive playbook on just how to run business. While franchising can be a faster way to business success, it brings its one-of-a-kind complexitiesespecially in the world of bookkeeping.

Examine This Report on Accounting Franchise

They need to adhere to the standards and requirements established by the franchisor, which can include everything from rates techniques to employee training methods. This makes sure consistency and uniformity across all franchise business locations, reinforcing the general brand photo (Accounting Franchise). The franchise version is a win-win circumstance for both the franchisee and the franchisor

The franchisor, on the various other hand, gain from the franchisees' investment and growth, as they generate earnings via franchise fees, recurring aristocracies, and the total growth of the brand name. In recap, a franchisor is click over here the entity that owns the legal rights and licenses to a brand or organization, granting franchise licenses to 3rd parties, understood as franchisees.

Excitement About Accounting Franchise

Correct audit methods are important for managing expenditures and making certain the success of a franchise. Franchise owners need to properly track their expenses, including startup expenditures, advertising and marketing costs, and pay-roll prices, to preserve a healthy and balanced money flow. Exact accounting is crucial for fulfilling monetary reporting requirements and adhering to legal responsibilities.

This includes the initial franchise business charge and various other startup prices like leasing a place or stocking up on supply. These initial expenses can be much higher than starting an independent company and contribute to a greater initial financial debt load. Unlike conventional little companies that may begin as single proprietorships and range up, franchisees often require a team right from the get-go.

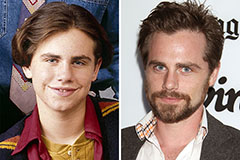

Rider Strong Then & Now!

Rider Strong Then & Now! Hallie Eisenberg Then & Now!

Hallie Eisenberg Then & Now! Anthony Michael Hall Then & Now!

Anthony Michael Hall Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Danielle Fishel Then & Now!

Danielle Fishel Then & Now!